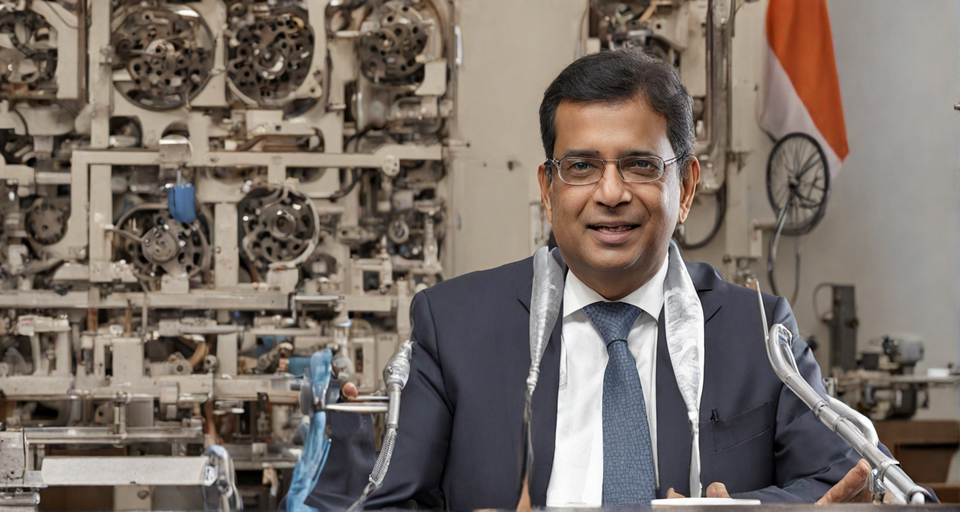

India to face pressure ahead…should focus on manufacturing reforms: Ficci President Subhrakant Panda

Despite potential short-term turbulence due to global economic conditions, India remains well-positioned to navigate through these challenges, according to Ficci President Subhrakant Panda. In an interview with Aanchal Magazine, Panda emphasized the need for the government to extend the concessional tax regime for new manufacturing units beyond 2024 to bolster the manufacturing sector. Here are the edited excerpts:

**Q: How do you anticipate the impact of global economic conditions on the Indian industry and economy?**

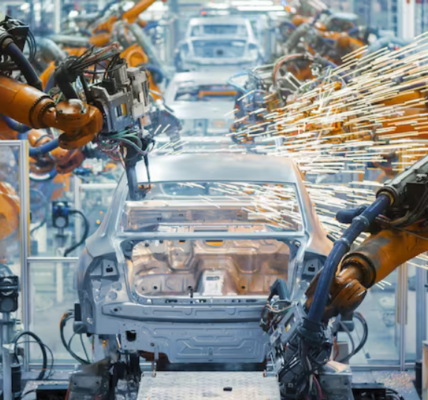

**A:** India’s current favorable position is attributed to well-timed pandemic stimulus measures and focused reforms. Despite being the fastest-growing large economy, global economic slowdown poses second-degree effects. Challenges include the impact of inflation in Europe and the U.S. affecting exports. To navigate this, India must stay committed to reforms and enhance manufacturing competitiveness.

**Q: What steps can India take to mitigate these challenges?**

**A:** Efforts to improve ease of doing business and reduce logistics costs will have a positive impact. Acknowledging the forthcoming turbulence, it is crucial to focus on the medium to long term. Panda suggests expanding the Production-Linked Incentive (PLI) schemes to high-export potential sectors and creating port-proximate clusters to boost manufacturing exports. Manufacturing needs to play a more significant role in India’s GDP for sustained economic growth.

**Q: How can India capitalize on the “China plus one” strategy?**

**A:** Panda advocates for extending the concessional tax regime for new manufacturing entities, slated to expire in 2024, to attract investments. Competing with geographies like Vietnam, Cambodia, and Singapore requires India to offer a competitive tax rate, potentially providing a clear five-year window for companies to move supply chains to India.

**Q: What about the impact of the corporate tax rate cut by the government?**

**A:** The corporate tax rate cut applies to existing units, allowing them the option to switch to a new regime. However, the concessional tax regime (115 BAB) has not attracted significant investment. While acknowledging this, Panda stresses the importance of the government’s commitment to boosting manufacturing.

**Q: How does the situation in China, with concerns over Covid cases and shutdowns, affect India?**

**A:** India’s efficient handling of the pandemic contrasts with China’s longer and stricter lockdowns, potentially causing disruptions to supply chains. Panda commends India’s proactive approach to vaccination. However, he expresses concern about the situation in China, emphasizing the need for global control to prevent disruptions and potential health risks.