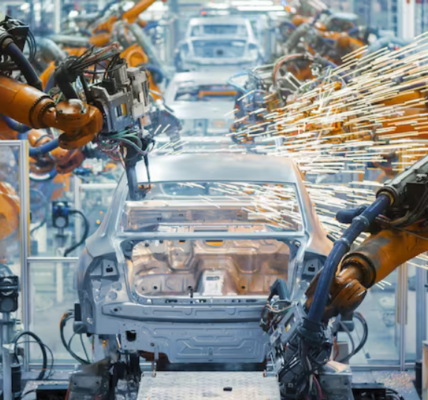

In June, the manufacturing sector in the country experienced its most robust growth this year, buoyed by an increase in both domestic and export orders, according to a monthly survey. The Nikkei India Manufacturing Purchasing Managers Index (PMI) climbed from 51.2 in May to 53.1 in June, marking the swiftest improvement since December 2017.

This marks the 11th consecutive month where the manufacturing PMI has remained above the crucial 50-point mark. In PMI terminology, a reading above 50 signifies expansion, while a score below indicates contraction.

Aashna Dodhia, Economist at IHS Markit and the report’s author, stated, “India’s manufacturing economy closed the quarter on a solid footing against a backdrop of robust demand conditions, highlighted by the sharpest gains in output and new orders since last December.”

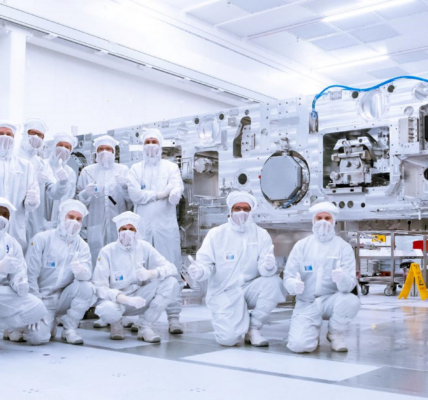

Driven by increased production needs, manufacturing firms increased purchasing activity and expanded their workforce. Dodhia noted, “On the jobs front, the latest survey data pointed to a healthy labour market, with job creation accelerating to the sharpest since December 2017.”

Regarding pricing dynamics, input cost inflation and output charges accelerated, suggesting potential pressure on the central bank to tighten monetary policy. Dodhia added, “Input cost inflation quickened to the strongest since July 2014 in June, suggesting that the central bank could remain under pressure to tighten monetary policy.”

In June, the Reserve Bank of India raised its retail inflation projection by 0.30%, maintaining a neutral policy stance while increasing the key rate by 0.25% to 6.25%. Despite the positive manufacturing outlook, business confidence weakened to its lowest since October, reflecting concerns about a potential market slowdown in the upcoming year.

Dodhia highlighted challenges in the 12-month outlook, including the prospects of tighter domestic monetary policy and persistently high inflation.